Explore the Future of Payments, & Smart Living

Send Money to Nigeria: How to Fund Your FLEX Wallet from Abroad

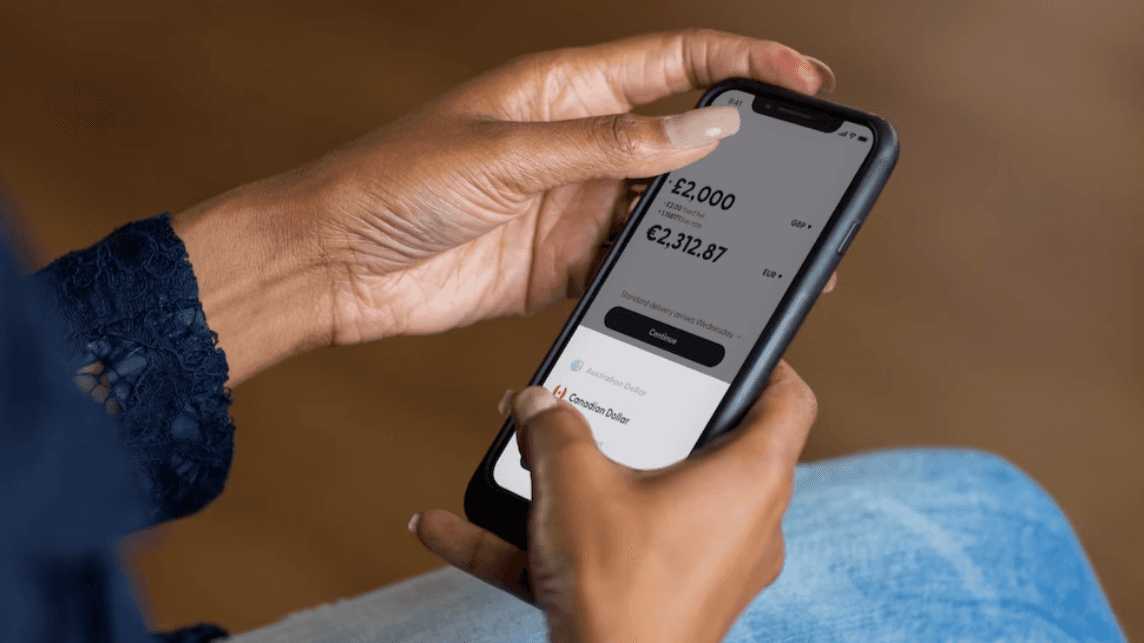

Living abroad doesn’t mean living apart. With your FLEX virtual account, you can fund your wallet directly through trusted remittance apps like Nala, Lemfi, or TaptapSend — fast, reliable, and ready for whatever you need in Nigeria.

Rise of CASHLESS payments

stdniskala February 13, 2025 Uncategorized The Rise of Cryptocurrency in Everyday Transactions Ditch the Old, Embrace the Future of Payments! February 13, 2025 | Uncategorized The way we handle money…

Rise of DIGITAL Payments

stdniskala February 13, 2025 Uncategorized The Rise of Cryptocurrency in Everyday Transactions Ditch the Old, Embrace the Future of Payments! February 13, 2025 | Uncategorized The way we handle money…